Is This The Beginning Of The 10x Rise In Silver Prices?

There has been a considerable co-movement between speculators and silver since 2014. Silver positioning score is 1.3. The non-parametric probability of reversal is 3.9%, making silver the most oversold precious metal.

Silver Trading ‘Oversold’ on Record High Short Position

Silver prices ‘vulnerable to short covering’ by Comex speculators…

Silver trading among hedge funds and other speculators last week stepped back from the most bearish position on record, but the metal remains “oversold” and “vulnerable” to a swift jump in price according to several analysts.

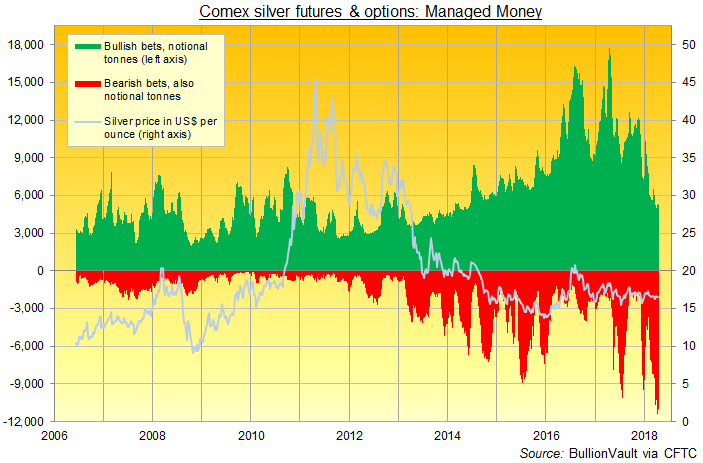

Betting on metal prices by trading silver futures and options contracts at the Comex and ICE exchanges, speculators in early April held a net negative position equal to a record 6,159 tonnes.

Last week that net negative position was trimmed by 8% overall as the number of bearish contracts fell and the number of bullish bets rose. But overall the net position still equated to ‘shorting’ more than a fifth of global annual mine output.

As a group, this ‘Managed Money’ category of trader has now been more bearish than bullish on silver prices for 9 weeks running according to data from US regulator the Commodity Futures Trading Commission.

That matches the record run of autumn 2014, when silver prices fell over 18% in US Dollar terms between mid-September and early November.

The last 9 weeks of bearish speculation in Comex futures and options, in contrast, have seen silver prices slip less than 2%.

Looking at the number of bearish bets, early-April 2018’s record large short position was more than 4.5 times the size of the last 10 years’ average gross bearish betting.

As for bullish betting, the recent low marked the smallest size since mid-2014, some one-fifth smaller than the 10-year average and barely 28% of the record high set in April 2017.

Silver is now “oversold [and] generally vulnerable to short-covering” said analysis of the CFTC data from French investment bank and London bullion market maker Societe Generale (PA:SOGN) on Monday. It notes that with the metal’s price sitting in the third lowest quartile of its historic trading range, bearish betting has never been greater while bullish betting has almost never been lower.

“As the stunning reversal of aluminum’s three-month decline last week demonstrated,” agrees a column on Bloomberg, “commodity markets can go wild when bearish investors are caught short.

“A lot of money is betting that the next move for silver is down, but it’s already looking cheap.”

Silver prices have in 2018 fallen to multi-year lows in terms of gold, a ratio which some traders use to judge the two metals’ relative value.

The Gold/Silver Ratio tracks how many ounces of silver you could buy with one ounce of gold, ignoring trading fees. Averaging around 53 over the last half century, it has risen above 80 so far this year, approaching the peaks seen in early 2016 and in 2008.

At first glance, says the new World Silver Survey 2018 from analysts Thomson Reuters GFMS, compiled for the Washington-based Silvr Institute, today’s high ratio of gold to silver prices “may suggest” that the cheaper metal offers a better investment “compared to gold in the long run on a ‘catch-up’ argument.

“[But] we should not ignore gold’s role as a safe haven,” GFMS warns. “Some smart money has been hedging against geopolitical risks and potential correction in equities” by trading gold rather than more industrial precious metals such as silver or platinum. – BullionVault

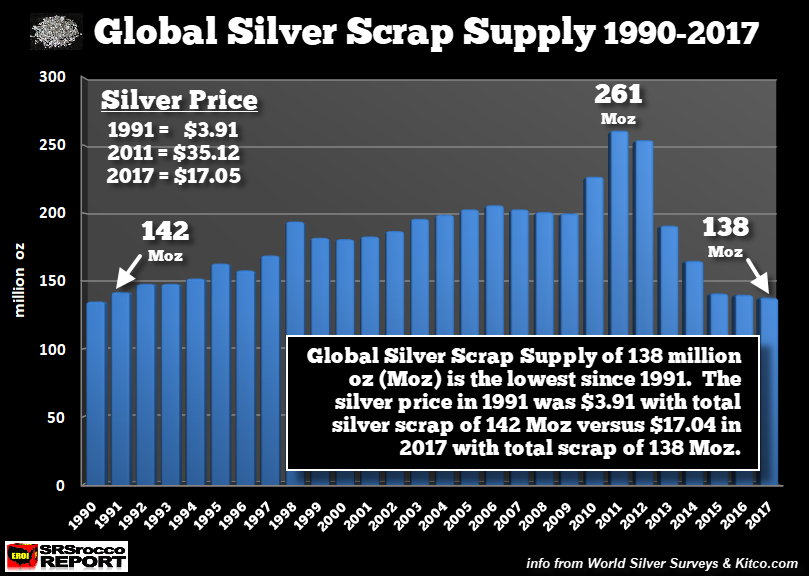

h2 Global Silver Scrap Supply Falls To 26-Year Low/h2Global silver scrap supply fell to its lowest level in 26 years. World silver recycling in 2017 dropped by nearly 50% since its peak in 2011. According to the 2018 World Silver Survey, global silver scrap supply declined to 138 million oz (Moz) compared to 261 Moz in 2011. While lower silver prices are partly responsible for the large drop in silver recycling, there are other market dynamics.

For example, silver recycling from the photography sector has declined since consumption peaked in 1999. The photography industry was using 228 Moz of silver in 1999 compared to the 44 Moz last year. Thus, silver consumption in photography has declined by 80% in nearly two decades… and along with it, a great deal of recycled silver supply.

Furthermore, a lot of silverware was recycled during the period of rising prices (2007-2012). A lot of Millennials who inherited their parent’s (and grandparents) silverware decided it was much easier to pawn it rather than spending a lot of time polishing it for holiday gatherings. Which means, a lot of available stocks of silver scrap have already been recycled.

As we can see in the chart above, even though the $17 silver price in 2017 was four times higher than in 1991 ($3.91), global silver scrap supply is less than it was 26 years ago. Moreover, world silver scrap was over 200 Moz a year (2005-2009) when the average annual price was much less than it was last year.

Now according to the Metal Focus Silver Scrap Report published in 2015, they forecasted the following percentages of silver scrap from the various sectors:

Industry = 60%

Silverware = 16%

Photographic = 12%

Jewelry = 10%

Coin = 2%

While it is well known that the majority of silver scrap comes from recycling of industrial silver waste, due to the industrial sector being the largest user of silver, jewelry only accounts for 10% but is the second largest consumer. For example, the 2018 World Silver Survey reported that the industrial sector consumed nearly 600 Moz of silver in 2017 while jewelry fabricators used 209 Moz. However, silverware and the photographic sectors only consumed 102 Moz, but account for 28% of silver scrap supply.

What this tells us is that owners of silver jewelry are not that motivated to pawn their silver jewelry because there just isn’t enough monetary value. So, a large supply of potential silver scrap will likely never make it to the market, even at much higher prices, due to the relatively small value of silver jewelry held by individuals.

As for gold jewelry, it’s quite the opposite. Nearly 90% of global gold scrap supply comes from recycled gold jewelry. Thus, a significant increase in the gold price would result in higher gold jewelry recycling, whereas a higher silver price would not generate much of an increase in silver jewelry scrap supplies. So, each year about 200 Moz of silver are used in silver jewelry fabrication, but only a small amount is ever recycled.

Lastly, annual gold scrap accounts for 28% of total global gold supply compared to only 14% for the silver market. Even at much higher silver prices, global silver recycling will not be able to supply enough metal when investment demand surges as the broader markets collapse. – SRSroccoreport

h2 Could Silver Prices Rise to $150 an Ounce?/h2It’s been seven years since the last big rally in precious metals. But the U.S. dollar and fiat currencies are in trouble, hinting that gold and silver prices could again go screaming higher.

As I explained last week, a collapse of the U.S. dollar is inevitable. The U.S. Dollar Index has been bouncing off of four-year lows for the past several weeks. But this cannot last much longer with a global trade war and U.S. equity correction looming.

The best way to prepare for U.S. dollar trouble is precious metals. Gold has been officially decoupled from the greenback for almost 50 years. But the two still generally trade inverse to each other.

And while gold is perhaps the safest way to hedge against a falling dollar, the most profitable option is silver. That’s simply because silver has more room to grow.

During the big precious metal rally of 2011, the price of gold reached over $1,900 an ounce. That’s about 50% higher than current prices ranging between $1,325 and $1,350 an ounce.

At the same time, silver traded for $50 an ounce. That’s more than 200% higher than silver’s current $16.50 price.

Gold prices have just begun to move higher after sitting dormant for weeks. But precious metal bull markets tend to follow a pattern.

What I mean is there’s a progression in price increases (and investor interest) that precious metals always seem to follow during bull markets. And it always starts with gold.

Gold is the very first precious metal investors tend to buy in bull markets, which pushes gold prices higher. But once the price of gold reaches a certain level, investors start buying up its more affordable cousin: silver.

There’s probably no better time than now to buy silver. If you’ve been reading Energy and Capital for a while, you know I believe the price of gold could swing over $5,000 during this coming rally. That would be a 300% gain from current levels.

But with gold at $5,000, there’s no reason to think silver prices couldn’t reach $150 an ounce or higher. That’s an +800% gain from current prices.

The first thing investors tend to think about when considering owning any precious metal is physical bullion. And while I think it’s important to own some physical silver bullion, there are a number of things to consider.

First is storage. Physical silver is bulky. At only $16 or $17 an ounce, most serious investors can afford to stockpile pounds and pounds of the white metal.

For $1,350 you can buy and store one ounce of gold. But for the same amount, you can buy 5.5 pounds of silver. Before buying a lot of physical silver, you should consider where you’re going to store it.

Then there are the premiums. The premium for physical silver is always much higher than for gold on a percentage basis. Right now, the premium on a one-ounce American Gold Eagle is about 5%. Meanwhile, the premium on a one-ounce American Silver Eagle is around 20%.

Again, it’s important to own at least some physical silver. But the bulk of your silver portfolio should be in equities. Silver stocks are simply easier to own and more liquid relative to physical bullion.

Find some good silver stocks and sit on them. There are big moves ahead. – Luke Burgess

VISIT THE KNOWLEDGE CENTER

Get Started Securing Your Retirement

Receive $2,500 in free gold as soon as your Physical Gold IRA application is approved.

Learn More About IRA Eligible Gold Coins

View IRA Eligible Gold Coins from the Royal Canadian Mint and the U.S. Mint.